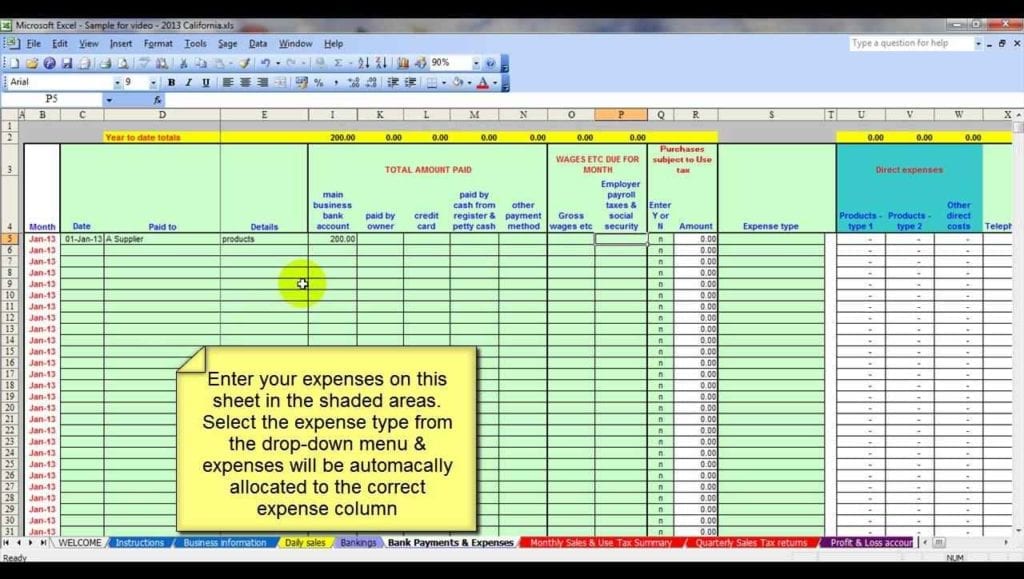

The software allows the owner to record the transactions on a real-time basis and thus eliminate procrastination.Ĭonsistency is the key to achieving better results, no matter what the activity. It also tends to become a habit before you know it.Ĭonsidering the fact that there are various accounting softwares in the market today, it would be advisable to invest in one so as to manage bookkeeping in a timely manner.

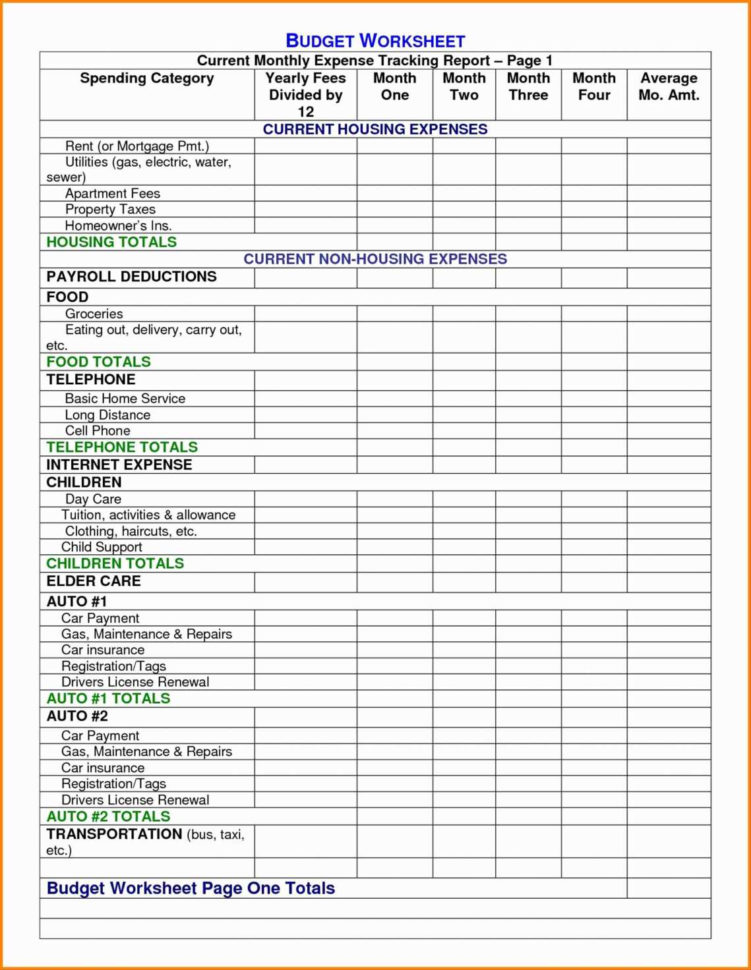

Often, procrastination can hinder progress. This proverb can be well understood, taking into consideration the activity of recording and bookkeeping. Never put off until tomorrow what can be done today. Bills, invoices, bank statements etc, are various sources of documentation that can help one track the expenses in an efficient manner. Moreover, this serves as an absolute blessing during the calculation of tax liability. This helps the owner regulate the outflow of cash and thus avoid wasteful expenditure. In order to be able to balance the books effectively and improve business, it is vital that the owner keeps a constant track of the expenses incurred. As a result, tracking and sorting bills has become a lot less complicated and less time-consuming. The advantage of getting an instant notification on the transfer of money through UPI is a blessing to many small business owners, who in the past have suffered losses due to the numerous bad debts accumulated.Īccounting software these days provides you with the option to generate bills and invoices, which describe the mode of payment opted for by the customer for each individual bill. Considering the convenience of UPI payments in today’s age, it is always better to offer that option to the customers so that timely payments are received. This helps keep track of the sales in an easier manner. The method of receiving payments, whether through cash, bank transfer or UPI, needs to be established and maintained on a consistent basis. This enables the owner to keep better track of the transactions and regulate his expenses on a consistent basis and in a manner that saves time.Įstablish your Methods of Receiving Payment The solution to the same is to open a separate account for business transactions. A lot of time and money is wasted on a problem that can be completely avoided. This leads to a considerable level of confusion while preparing the books of accounts, the reason being the difficulty in distinguishing between personal expenses and business expenses. More often than not, small businesses tend to operate and undertake all their business activities through their personal bank account. Once all these questions have been answered by weighing the respective pros and cons, one can make an informed decision and thus reach a successful conclusion.

The following tips will help for efficient bookkeeping and maintain proper books of account: Decide on the Method of Bookkeepingįirst and foremost, one must determine whether the business will be maintained on a cash system or accrual system of accounting.

0 kommentar(er)

0 kommentar(er)