A business can use bookkeeping software to create special accounts, to track purchases of items. Need An Accounting Software for Your Business? Jurnal is The Solution to the Double Entry Bookkeeping SystemĪccounting software is typically used to perform double entry bookkeeping. On both sides, the answer to this equation must be the same.Īs a result, if assets increase, liabilities must increase as well in order for both sides of the equation to balance.

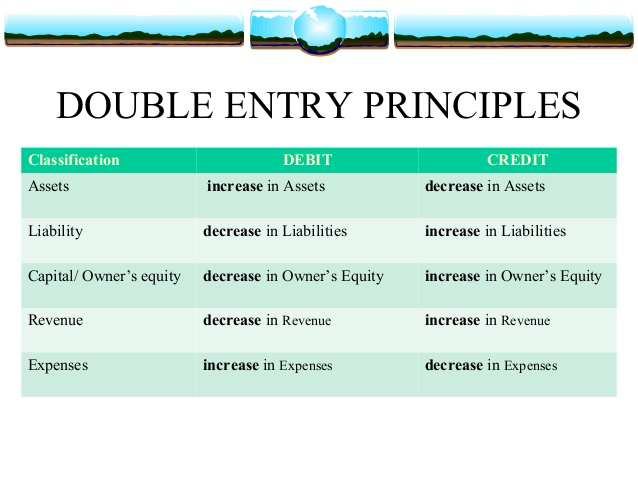

When we look at the accounting equation, one of the fundamental concepts of accounting, the above becomes evident. Whether an account has a typical debit or credit balance, and hence whether debits or credits increase the balance, is determined by the account type. There are two sides to each journal entry, with debits on the left and credits on the right. When documenting transactions in double entry bookkeeping organizations can utilize any combination of the five categories of accounts – assets, liabilities, equity, revenue, expense, gains and losses. Finally, producing balanced financial accounts necessitates more effort during the closing process.īecause single-entry accounting isn’t recognised by GAAP, it can’t be used by public corporations. It also doesn’t account for items like credit card sales. While single-entry accounting is easier to set up, it has a number of drawbacks when compared to double-entry accounting.īecause it lacks the double entry bookkeeping control method of balancing accounts, it is more prone to errors, particularly omissions and duplications.įurthermore, because it simply tracks cash inflows and outflows, reflecting when cash is in hand versus when it is earned, single-entry accounting does not provide a complete financial picture of the organization. Each entry in cash-basis accounting consists of a debit or credit to a single account, as the name implies. accrual accounting is directly related to single-entry accounting and double-entry accounting.

Single-entry accounting resembles a check register or bank statement with a list of transactions. Get a detailed picture of the company’s finances.įor recording financial activities, single-entry accounting is an alternative to double entry bookkeeping.To balance the line items, the transaction is recorded twice, once in subtraction and once in addition.ĭouble entry bookkeeping can assist you in the following ways: Simultaneously, you would deduct $5,000 from the company’s present debt, which is considered a credit. The cash account of your corporation would be depleted by $5,000 this is a debit/expense. Let’s imagine you have a $5,000 amount on a business credit card that you wish to pay off. You can look into why the columns aren’t balancing. The term “double-entry” refers to the fact that each transaction is recorded twice, once in the expenses and once in the credits. A credit is applied to at least one account, while a debit is applied to at least one other account.Įvery company transaction has equal and opposite consequences on at least two accounts, according to the double entry accounting approach.Ĭonsider a spreadsheet that has two columns: one for expenses and the other for credits. What is Double Entry Bookkeeping in Accounting?ĭouble entry bookkeeping is an accounting method in which a transaction is simultaneously recorded in two or more accounts. Financial transactions are recorded by bookkeepers as journal entries, which increase or reduce the amount of money in various accounts depending on the type of transaction.Įach journal entry in double entry bookkeeping updates at least two accounts in the general ledger of the company, using an equal balance of debits and credits to those accounts.Įach journal entry is considered to have two sides since it contains both debits and credits. Continue reading to find out what double-entry accounting is and how it can help you with your finances.Įvery company’s accounting system is built on the foundation of journal entries. What is Double Entry Bookkeeping? How Does It Work?ĭouble entry bookkeeping is one method for keeping track of your finances.

0 kommentar(er)

0 kommentar(er)